3 Things: DAO Marketplace, Levi's of the Metaverse, Fractional Ownership of Cash Flow Biz

Happy Sunday and a very warm welcome to all the new subscribers! I’m thrilled and honored to have you as readers and truly appreciate your thoughts and feedback 🙏. Each edition of 3 Things will contain a dive into 3 rabbit holes I’ve found myself going down recently. Subscribe to get each week’s edition straight to your inbox and if you enjoy it, please share (I suck at self-promotions so can use your help)! This past week I’ve been thinking a lot about:

DAO Marketplace

Levi’s of the Metaverse

Fractional Ownership of Cash Flow Businesses

1. DAO Marketplace

Outside of NFTs, the other 3-letter acronyms you’re probably hearing a lot about right now in the crypto world are DAOs. A DAO or decentralized autonomous organization is a new type of corporate entity without central leadership, but managed and governed by the community. Decisions are made collectively by members and executed via smart contracts where the rules and logic governing the organization are written in code. The first DAO (comically called “The DAO”) was created in April 2016 as an investor-directed VC and raised capital via a token crowdfunding campaign garnering over $150M worth of ETH from 11,000 investors in only a few weeks. Within a month of the fundraise, a vulnerability in the smart contract was exploited, draining around 1/3 of the funds into an account that was subject to a 28-day holding period. The Ethereum community had to make a hard decision as to what they would do and ultimately decided to hard fork the entire blockchain in order to return the funds, creating Ethereum and Ethereum classic.

There are new DAOs popping up almost every day now but finding them and actually participating in them is still nontrivial. There is an opportunity to build the OpenSea for DAOs. OpenSea made it easy for individuals to discover and create new NFTs by aggregating them into a marketplace and offering consumer-friendly tools to buy, sell, trade, and mint various NFTs. Since launching in 2017, OpenSea has raised over $127M at a $1.5B valuation, and they are rumored to be getting offers now at a $10B valuation. They’ve crossed $10B in all-time sales transactions and have solidified their place at the top of the NFT food chain. Recently, we’ve seen the rise in DAO popularity with thousands coming together to attempt to purchase a copy of the US Constitution, build a new city in Wyoming, and Kimbal Musk’s (Elon’s brother)Big Green DAO which is a philanthropic DAO focused on food security. Create a user-friendly marketplace that aggregates all DAOs, provides information on each, and enables users to contribute to individual DAOs and manage their contributions (including voting and governance) across all of them.

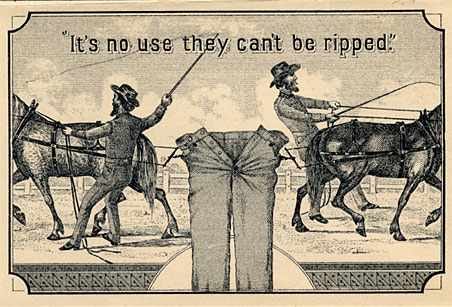

2. Levi’s of the Metaverse

It is now widely known that during the California Gold Rush which began in 1848, merchants made far more money than miners. The wealthiest man of that era was in fact Samuel Brannan who was a shopkeeper and newspaper publisher that bought up supplies in San Francisco and opened stores in all of the major mining outposts, selling his wares at a significant profit. One of the most famous stories of a Gold Rush entrepreneur is that of Levi Strauss. Story goes that in 1853, Levi stitched together a pair of pants made out of canvas that became incredibly popular with miners and helped kickstart his fortune. In reality, he made his early money through his dry good stores in mining towns and then in 1873, he added metal rivets to his pants to reinforce the seams and make them stronger and the blue jean was born.

In the VC world, we often talk about building the “picks and shovels” plays in new markets which has its roots in selling picks and shovels (and other necessities and luxuries) to miners in the Gold Rush. Today, the only thing buzzier than DAOs and NFTs may perhaps be the metaverse which is emerging as the largest new platform for entrepreneurs to take advantage of since the smartphone. While it’s unclear if a single company like Meta (fka Facebook) or a plethora of companies will come to dominate the metaverse, there will be many “picks and shovels” opportunities to take advantage of and build Levi’s-type businesses catering to this audience. Digital clothes and accessories, virtual land and property (Decentraland and Sandbox have been absolutely exploding), art, wine, collectibles, and pretty much anything else you use in your day-to-day life could be an opportunity to sell items to users transitioning more and more of their lives into the digital metaverse. Tons of opportunities abound here and we are already seeing some companies starting to build or take advantage of the opportunity like Nvidia and Roblox.

3. Fractional Ownership of Cash Flow Businesses

The concept of fractional ownership has existed for decades. It originated with business jets in the 1960s which were extremely expensive, so Richard Santulli created NetJets which allowed people to share the cost of private jets. Typically, fractional ownership is used for high-value tangible assets like real estate, yachts, or planes. The concept of a timeshare for residential real estate has also existed since the 60s and became popular in Europe after WWII and then in the US in the 1970s. Recently, we’ve seen Pacaso, a company using the fractional ownership model for 2nd homes that was started by former Zillow founders Austin Allison and Spencer Rascoff raise an eye-popping $1.5B in under a year. We’ve also seen other fractional ownership models emerge for alternative high-value assets like Masterworks for fine art or Rally for exotic cars.

While fractional ownership traditionally has been applied to assets where the investors intend on utilizing it part time, the same model can be applied to pure revenue-generating endeavors like owning part of a cash flow business. Things like car washes, storage units, mobile home parks, laundromats, and more can yield great monthly passive income. Yet, for the average person, the idea of owning one of these businesses doesn’t seem approachable. There are tons of courses you can pay for online that teach you all about investing in and managing cash flow businesses but what if there was a way to just enable you to invest in one without doing any work? The company would do the heavy lifting to identify the right assets, handle all of the management, create an easy-to-use platform for investors, and then pay out profits/dividends to investors. Just like many of the other alternative investment platforms, you could trade in and out of various positions as liquidity is created among the investor pool.

That’s all for today! If you have thoughts, comments, or want to get in touch, find me on Twitter at @ezelby and if you enjoyed this, please share with a friend or two!

~ Elaine