3 Things: Plant-Based Meat Import/Export, TurboTax for Dummies, NFTs for Donations

Happy Sunday! Each edition of 3 Things will contain a dive into 3 rabbit holes I’ve found myself going down recently. Subscribe to get each week’s edition straight to your inbox and if you enjoy it, please share! This past week, I’ve been thinking a lot about:

Plant-Based Meat Import/Export

TurboTax for Dummies

NFTs for Donations

1. Plant-Based Meat Import/Export

Over the last decade, both the supply and demand of plant-based meats, seafood, and diary has exploded. In 2010, pretty much only Beyond Meat existed and was in its infancy, well before they had a viable product. In the past 3 years alone, there has been more that $1.2B of venture capital poured into the industry and we now have dozens of companies providing beef 🥩 (Beyond Meat, Impossible Foods, Next Level Burger), fish 🐠 (Good Catch, Wild Type, Shiok), chicken 🍗 (Nuggs, Rebellyous, Quorn), dairy 🥛 (NuMilk, Grounded, Ripple), and much more. Since 2019 when Beyond Meat went public, the US interest and demand for meat alternatives has skyrocketed due in large part to the availability of these products on grocery store shelves and in restaurants which is also driving major food manufacturers like Nestle, Perdue, Tyson, and Hormel to enter the market.

While this taste for plant-based is newer in the US, alternative meats have been prevalent in China and greater Asia for decades. Given the existing demand in Asia (and expected massive rise over the next few years), the growing demand in the US, and the proliferation of new brands and types of products, it makes sense for a company to act as the importer/exporter of products between Asia and the west. It would be a huge opportunity for US companies to gain access to the Asian market and their gigantic population who already have an appetite for these types of products. Given both the large immigrant population and growing desire for Asian products in the US, it would also be quite lucrative to bring Asian alternative meats to the US and act as the importer. The primary routes today between the US and Asia (in particular China, Japan, Korea, and Thailand) are already very mature and robust trade channels, so navigating the nuances required to act as the importer/exporter should be relatively straightforward, though definitely not easy, which also helps build defensibility and some semblance of a moat.

2. TurboTax for Dummies

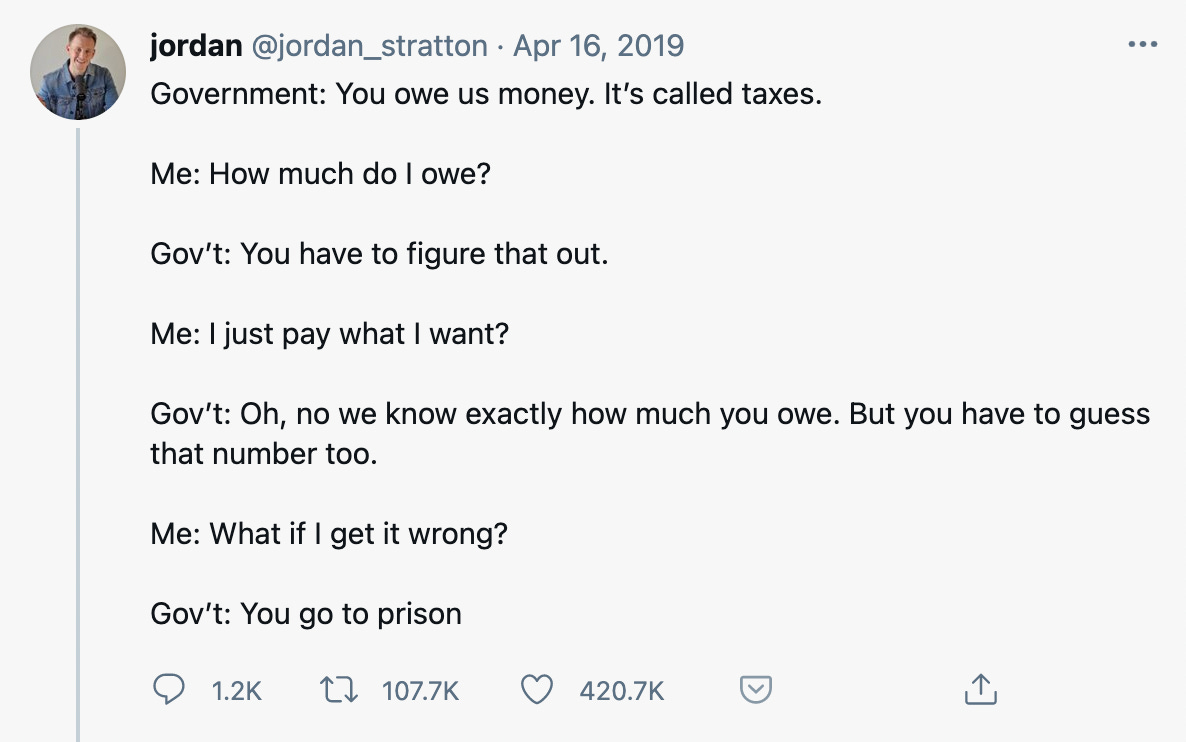

It’s tax season again which means that millions upon millions of Americans will be stressed, frustrated, and scrambling to file their taxes. Each year, I’m consistently shocked at how absolutely backwards our tax system is. The tweet above sums it up pretty nicely but also add in the fact that you have to track down random literal paper that’s mailed to you (oh and not at the same time, it comes to you randomly over the course of a few months). Once you have all your documents like your 1095-B which is literally just showing you had health coverage (why can’t they just call it that!?!) you get asked a bunch of ridiculous questions that even I, a person with 2 engineering degrees from a top university who has worked in tech for a decade cannot decipher. If you have anything even slightly complicated like the sale of stock, purchase of equity, crypto trades, rental income, alternative sources of income, good luck trying to get it right on your own. Suffice it to say, I’m annoyed.

Since most people don’t have access to a tax accountant, millions turn to TurboTax, now a part of Intuit, to file their taxes themselves. It’s a cheap and “easy” way to get it done but every time I use it, I want to pull my hair out after spending hours googling terms and trying to figure out how to correctly fill out forms that look like this (which have circular references to other forms) to determine certain eligible deductions. It’s 2021; everything is digital. Why is there no tax filing application that easily connects to my payroll system, my health benefits system, any investment accounts, my mortgage account, etc? ALL of the relevant information that is necessary for figuring our our convoluted tax apparatus is sitting in existing digital systems of record that I can login and connect to. The platform should be dumbed down and made accessible for anyone to navigate. Gamify all of the worksheets for deductions in a super simple, Buzzfeed quiz type manner. Make it idiotproof to ensure you’ve collected all necessary information and that you’ve determined all of the ways that you can receive eligible deductions and credits. As opposed to forcing the individual to know what to look for and where loopholes exist (current state of the world with TurboTax), create a fun game where you get a series of cards that pop up with yes/no questions to see what you might be eligible for. Very similar to what Mainstreet is doing to help companies find, apply, and receive government tax credits and incentives, a consumer solution like this needs to exist to automate the entire tax filing and optimization process.

3. NFTs for Donations

My guess is that most of you had never heard the term NFT (non-fungible token) until the last few months. Now, it feels like that’s all anyone is talking about. It’s very reminiscent to late 2017 when the masses became aware of Bitcoin and the concept of a blockchain for the first time. Cryptokitties, the gamified app that lets you buy and breed unique digital cats, was the original use case that popularized the concept. Dapper Labs, the company behind Cryptokitties, is back at it now partnering with the NBA to launch NBA Top Shot where people can buy and trade unique snapshots of top plays from NBA history. Between a Top Shot of Kobe Bryant being purchased for $208,000 or a single piece of digital art by artist Beeple being purchased for $69M, it definitely feels like we are at peak NFT mania and hype right now.

Today, most use cases for NFTs stem around digital art, collectibles, or ownership of items within gaming. Back in 2017-18 when I was working in the blockchain space, we had been incubating or discussing a variety of other use cases for NFTs including things like credentials/certifications, title on a house or car, supply chain provenance, and much more. Pretty much anything that is a unique digital asset where you’d want to track the entire history of ownership and usage could make sense as an NFT. One area that I think could be a fantastic use case is for tracking donations and charity. When you make a payment to your charity of choice today, you have no idea what is done with that donation. The whole reason sites like Charity Navigator exist is that money is often not being used for the purported purposes which means third party companies need to sleuth and provide donors with as much transparency as possible. Using NFTs to track donations, you’d have a record of exactly where that money went, how it was uses, and by whom; available for anyone to see at any time. As a very concrete example, if you wanted to sponsor a child’s education in Honduras, you could buy a $1000 donation NFT tied to that chile where you’d be able to track exactly how that $1000 was spent and whether it went towards the books, tuition, and a uniform as intended. This would hold organizations accountable for how donations are handled, allow donors more control over what exactly their money is used for, and also ensure that money is being funneled to the places where it can have the most impact.

That’s all for today! If you have thoughts, comments, or want to get in touch, find me on Twitter at @ezelby and if you enjoyed this, please subscribe and share with a friend or two!

~ Elaine

Tracking $ donations is a great idea but not sure how that would be done using an NFT?? At some point, value must be exchanged for fiat and the ability to track on a blockchain dissappears. Where we need this ability even more than charitable donations is government spending. If citizens were able to track spending we would see a drastic reduction in waste and corruption.